Hudson’s current management is again resorting to Survey Monkey in an attempt to build a consensus in favour of accepting a $2M government grant — with strings attached — to lower the cost to taxpayers of the Sandy Beach acquisition.

Hudsonites may recall how the SM polling app was last used to build support for changes to urban planning bylaws that would have, among other things, taxed property owners for renovations. The aim — to generate revenue for greenspace acquisition — didn’t sway irate residents, many of whom saw it a blatant tax grab. Mayor Chloe Hutchison and her council backed off far enough to appease most complainants.

The Monkey’s return raises hard questions about why the Montreal Metropolitan Community’s $2 million subsidy offer is suddenly a priority. The preamble to the opinion survey (found on the town website) tells us “Council is currently inclined to accept the $2-million CMM Trame verte et bleue grant to help reduce the cost of acquiring Sandy Beach for taxpayers.”

But we’re not talking about major savings per household — $37 per year over loan bylaw 782’s 40-year lifespan. Is a $37 annual savings per household worth losing control of who can access an ecosystem described by Teknika, Cima+ and Eco2Urb biologists as the one most in need of protection?

Even Save Sandy Beachers attending last August’s public information session raised concerns about the potential costs of taking the CMM’s money. Nicolas Milot, the CMM’s director of ecological transition, explained then that if the town accepts the grant, anything the money is used for must be equally accessible to all 4.3 million CMM inhabitants — close to half of Quebec’s entire population. There was no rush, Milot reassured the audience — the town had until March 2026 to make up its mind.

Now, with barely two weeks until the March deadline, what factors could be pushing council’s agenda in favour of accepting the CMM grant?

— Unrealistic borrowing costs. According to the Loan Settlement Request (LSR), an internal document filed with the municipal affairs ministry in late September, Hudson has Quebec’s permission to borrow $7,648,136, payable over 40 years at an interest rate of 3.10%. Estimated annual cost: $336,246, shared equally between 2,785 units. That works out to $120.73 per unit, although you won’t find that number anywhere in the loan bylaw.

(Loan Bylaw 782 defines a unit as a residence, residential/commercial rental space —occupied or not — or unbuilt cadaster, regardless of size, frontage or assessed value.)

What are the chances of a Quebec municipality being able to depend on a 3.10% interest rate for the duration of a 40-year loan? Here’s a ChatGPT summary:

Current market benchmarks for long-term public debt in Canada are above 3.10 %, generally closer to 3.5–3.9 %.

Municipal borrowing costs usually include a spread over those benchmarks, implying that locking in a 40-year fixed rate of ~3.10 % outright would be relatively uncommon at this time.

Over a full 40-year average across multiple interest environments and refinancing events, a ~3.10 % average is possible but would require extended periods of low rates relative to current long-term levels.

— Surplus mismanagement? The LSR locks the municipality into appropriating $2M from the town’s unallocated surplus to cover the spread between the $9.6M bill of sale and the $7.6M loan bylaw. It could have doubled that, reducing the debt burden on taxpayers by the same $37 as the CMM subsidy. The document makes it clear why the administration didn’t double the transfer from the surplus: it would have reduced the town’s borrowing capacity for a new public works building, town hall and a growing list of infrastructure imperatives contained in this administration’s 2026-28 capital investment plan.

— Assessment error? The LSR raises the possibility that the town overpaid for unbuildable wetland by ticking the Yes box to the following question:

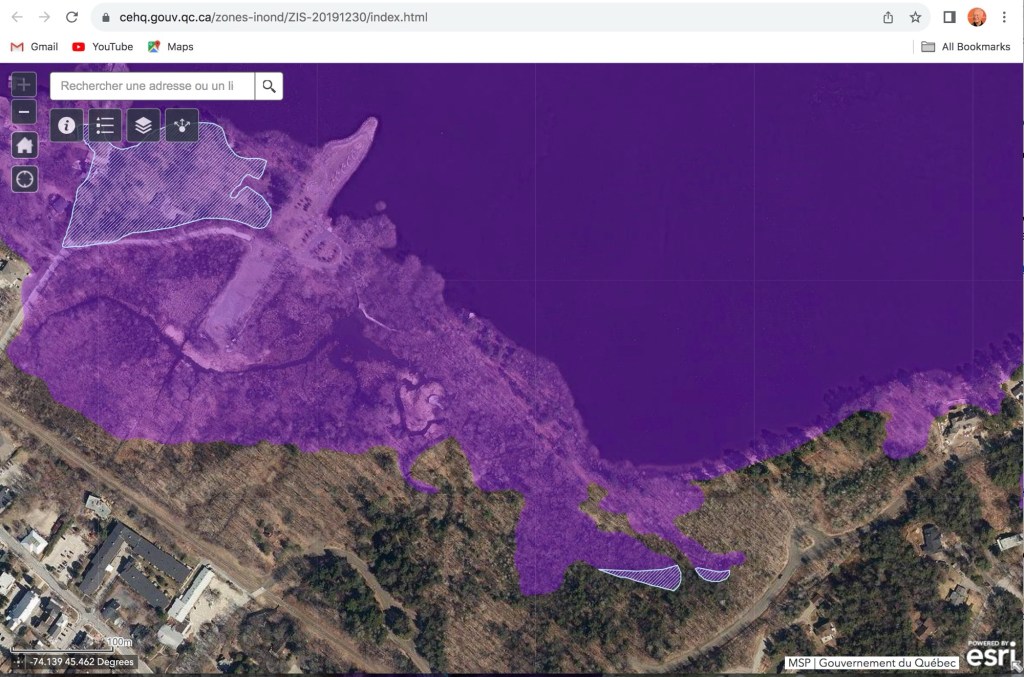

Following the Spring 2019 flooding, the Quebec government decreed a ZIS (special intervention zone). Does the object of the loan bylaw fall entirely outside ZIS territory?

The environment ministry’s own map of the 2019 flooding shows at least half of the entire Sandy Beach acquisition falling within the floodplain. Is it outside Quebec’s latest maps?

— Is this council banking on additional funding, either from the CMM or other sources as suggested in Section 8 of Loan Bylaw 782-2025?

Council shall allocate to the reduction of the loan decreed by this By-Law any contribution, donation, and subsidy that may be paid to it for the payment of part or all of the expenditure decreed by this By-Law.

Council also allocates any subsidy payable over several years to the payment of part or all of the debt service. The repayment term of the loan corresponding to the amount of the subsidy will be automatically adjusted to the period set for the payment of the subsidy.

Like the preceding extract, the Survey Monkey blurb is a masterpiece of wishful thinking and good intentions, culminating in this gem:

“The agreement is to ensure financial compliance, not political or operational control.”

This administration attempts to present acceptance of the CMM subsidy as a fiscal measure. In the absence of a promised conservation and management program, it threatens to become an unbudgeted exercise in controlling access to one of the very few free public beaches in the Greater Montreal region, home to more than 4 million people.

Once that CMM grant is in the town’s hands, beach access is no longer a matter of regulating usage. It becomes an as-yet-unresolved public security issue. Unless it bars all public access to Sandy Beach pending a conservation and management program, the administration will be powerless to prevent unauthorized uses such as illegal fires, swimming and off-leash dog activities.

In this context, Hudson’s taxpayers will spend the next 40 years paying for an amenity to which they no longer have access. In a transparent world, Mayor Hutchison and her council should have found a more democratic means of measuring how residents feel about accepting the CMM subsidy. Time to get this Monkey off our backs.