I wrote this column back in January 2014. I was sick of hearing a succession of councils weaselling out of the Town of Hudson’s 2006 promise to west end residents the water bylaw included a line to the west end.

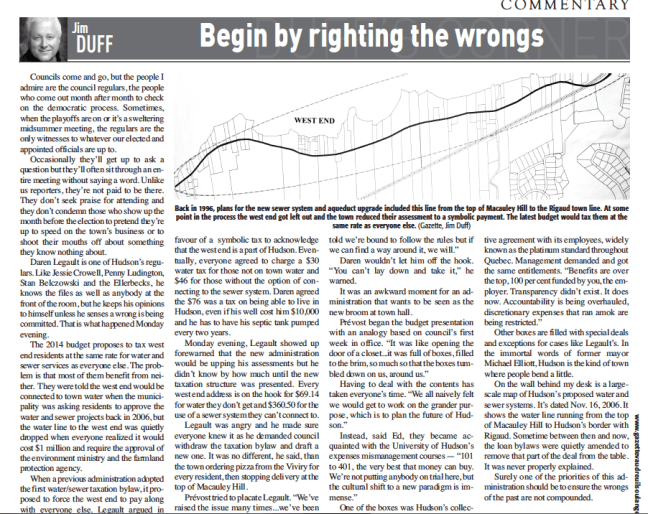

The photo is of part of the map drawn up by LBCD which was presented at two public loan-bylaw meetings in November 2006. The map formed part of LBCD’s funding proposal to the federal and provincial governments. The administration of that period claims the west end aqueduct was removed from LBCD’s proposal because it would have driven up the cost of the project. Who made the decision? LBCD? Quebec? The administration?

Before this and future administrations spend a dime on wish-list projects, they have to attend to this. It’s an open wound, a reminder of promises made for the sake of political expediency and an insurmountable obstacle to equitable taxation. A competent administration would have dealt with this in their first budget.

What promises were made during those loan bylaw consultations in return for citizen support? These are from the Nov. 29, 2006 Hudson Gazette: pg-01 pg-04 pg-14 pg-44

On Dec. 6, 2006, Mayor Elizabeth Corker first brought up the possibility of metered water for businesses.

Hudson mulling water meters

By Elyse Amend

HUDSON — Businesses on Main Road may be seeing water meters installed to determine how much they should be paying for sewerage.

Originally the Town of Hudson had proposed to tax buildings and businesses their share of the new sewer system on the basis of how much water they consume, but widespread dissatisfaction forced the town to rethink the formula.

The original taxation structure would have seen businesses taxed according to their daily estimated water use in litres. While most offices and stores, would end up paying on the basis of one residential unit, or 675 litres per day, restaurants would be taxed on the basis of 135 litres per seat per day, reflecting how much water is used for food preparation, cooking and cleanup. Beauty salons would be assessed on 650 litres per day per cutting chair, while bars would pay taxes on eight litres per day per client. Doctors and dentists would be taxed on 275 litres per day per professional, while cleaners would be assessed on 2000 litres a day.

Many businesses complained that the formula doesn’t represent the amount of water they really use, so the Town of Hudson is proposing to instal water meters in the business district, said Mayor Elizabeth Corker.

“It looks like the most logical thing to do. Certainly for some businesses that have installed more efficient equipment, they’re likely to use less water,” Corker said. “The idea’s not to undercharge and the idea’s not to overcharge. We’re trying to make it fair for everybody.”

Complexes that house several businesses, such as Shaars, Lancaster Place, and Poiriers, will have one meter installed for all the units. Property owners will be taxed for the entire complex, and will be responsible for passing on the charges to their tenants.

Meter readings would be done over the course of a year to establish actual consumption.

“Probably what we’re leaning towards right now is, we’ll have at least a year to figure out what their consumption is, rather than basing it on hypothesis,” Corker said.

If the loan bylaw is approved, sewer installation could start as soon as this spring, but may be pushed to the fall if there are delays. The Town proposes to ensure that major traffic disruptions won’t take place during the peak summer months, the mayor added.

On Dec. 13, the Gazette ran this story on how costs would be split. This is the first mention that west-end residents would be getting and paying for town water:

Water-system improvements by the numbers:

Total cost: $6.4M

Minus: federal/provincial infrastructure grants: $1.6M

Cost to ratepayers: $4.8 million ($2.4M over 25 years plus $2.4M over 40 years

Annual cost per address: $145 ($122 for loan bylaw, $23 for operation)

Note: Everyone drawing Town water will pay the $240 water tax as a separate line item on their tax bills. West-end residents may choose to continue drawing water from a private well, but will pay $122 because nearby fire hydrants will reduce their insurance costs.

Sewer project by the numbers:

Total cost: $14.8M

Minus: federal/provincial infrastructure grants, excise tax rebate: ($9.1M + $825,000)

Cost to ratepayers: $5.7M ($1.8M over 25 years plus $3.9M over 40 years

Cost split: 70% paid by 30% of all addresses, the remaining 30% paid by the unserviced 70%.

Proposed annual cost per residence: 789 serviced addresses would pay approximately $474 per year ($335 + $139 in operating costs), while 1995 unserviced addresses would pay $60 per year.

Proposed annual cost per business: To be determined on the basis of ongoing negotiations.

Note: The Town proposes to tax the 144 businesses in 122 serviced buildings on the basis of how much water they consume, and therefore how much they discharge into the sewer system. Water consumption was to have been calculated on a per-unit basis derived from provincial guidelines. Those guidelines define a residential unit as 675 litres of water per day — 270 litres of water per person per day, multiplied by 2.5 persons per address.

Guidelines:

• Restaurant water consumption would have been rated on the basis of 135 litres per seat per day, a reflection of the amount of water used for dishwashing, food preparation and equipment cleaning. The number of terrace seats would be divided by two. An 80-seat restaurant serving three meals a day, seven days a week would pay more than a 90-seat establishment open five days a week for breakfast and lunch.

• Daycares: 75 litres/person/day

• Professional offices: 50 litres/employee/day

• Retailers: 50 litres/ employee/day

• Bars: number of clients multiplied by eight litres of water/day.

• Dry cleaners: 2,000 litres per day.

• Medical and dental offices: 275 litres/day per professional, 75 litres/day for office personnel and 25 litres/day per patient.

• Hairdressers: 650 litres per cutting chair per day.

• B&Bs: 180 litres/guest/day.

I have yet to find a story reporting on the loan bylaw’s approval or how many, if any, residents signed a register which would have forced either or both bylaws to a referendum.

I recall a story in 2007 quoting Corker as saying the west end water line was off the table, but I can’t find it. Next step is to go through all the bound copies and page PDFs for 2007 and 2008.

This March 12, 2014 update marks the entry of the Prévost administration in the file.

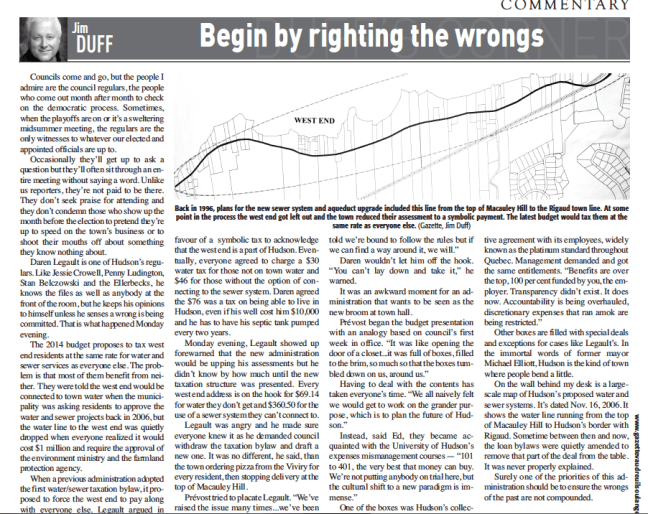

PHOTO: Hudson’s sewage treatment plant was a $5.5 million piece of a $23.3 million puzzle. If unserviced sectors are exempt and Hudson’s three schools can’t be forced to pay, who is left to foot the bill? (Gazette, Jim Duff)

HUDSON

Town grapples with long-term debt scenarios

By Jim Duff

What percentage of Hudson’s $32.5 million in long-term debt represents the cost of the sewage treatment system? The waterworks upgrade? How much represents a dozen other loan bylaws approved over a dozen or more years?

What happens if Quebec upholds a citizen’s complaint at having to pay for a service they’ll never get?

It’s challenge facing mayor Ed Prévost and the administration as the town braces for two municipal affairs ministry (MAMROT) decisions.

The first is on the legality of $23.3 million in waterworks and sewer loans authorized under three borrowing bylaws already approved by MAMROT. Last week, town manager Catherine Haulard urged citizens to complain to MAMROT on the basis taxpayers can’t be forced to pay for services they can never hope to receive.

If MAMROT acts on those complaints, the town could be required to rewrite and re-adopt one or more of the original loan bylaws.

The second is whether Quebec will honour its commitment to service more than $6.5 million of Hudson’s long-term debt.

Late last year, MAMROT informed the town it won’t begin paying the interest and carrying charges on its $6,572,428 share of the deal until the audit of every contract is completed. Prévost said the town has heard nothing more.

Earlier this week, Prévost cited figures showing Hudson requested a total of $15,085,331 to install sewers, build a treatment plant and upgrade the town’s waterworks under the federal-provincial infrastructures program. Of that, $13,074,428 was entered in the town’s books as receivable.

So far, $6,502,000 has been received from the federal government in a lump sum.

If and when MAMROT agrees to pay what it committed to, Hudson taxpayers are on the hook for $10,225,572 over 25 years.

But if MAMROT refuses outright or delays the decision on the basis of the audit, add the annual cost of servicing an additional $6,572,428.

The 2014 budget earmarked $896,742 to finance the town’s total long term debt and $905,056 for repayment of principal.

The mayor assured residents they would be getting adjustments to their tax bills in coming days and said that if MAMROT forces the town to rewrite the original loan bylaws, council has the option of extending the term to 40 years.

Former mayor Elizabeth Corker says MAMROT signed off on every one of the water and sewer loan bylaws at the time. “Never once in 16 years did we have a loan bylaw returned,” Corker added Monday.

“Why are they opening this Pandora’s Box? We spent two years negotiating with MAMROT, traipsing down there every week with the engineers.”