As promised, the Town of Hudson has posted a more detailed list of changes to proposed bylaws 767 and 768 replacing or modifying the the town’s urban planning regulations.

But it still hasn’t spelled out how the current council proposes to tax new or replacement residential development in the town centre — or what parts of town will be subject to this reinterpretation.

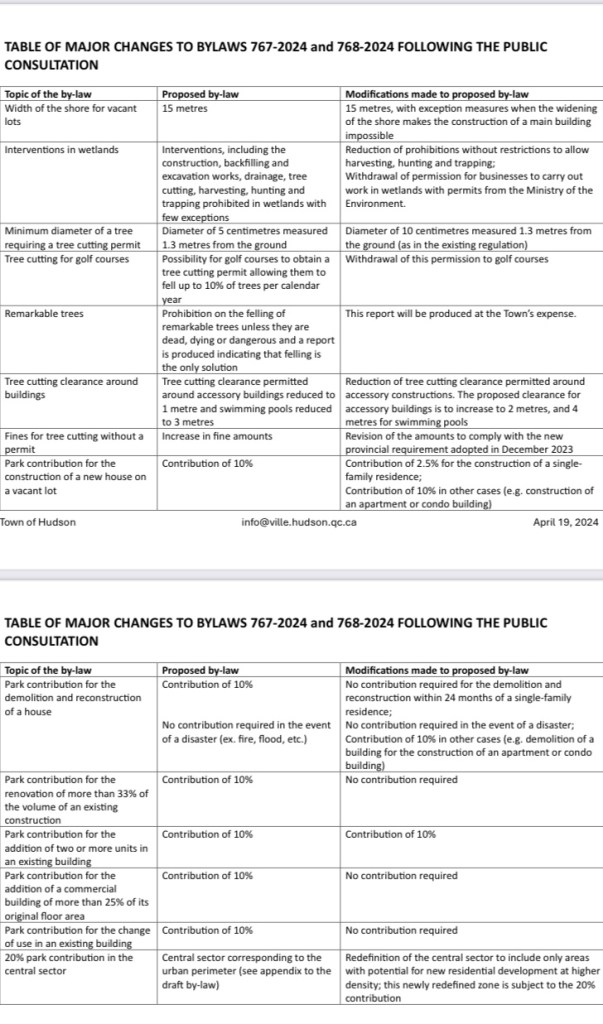

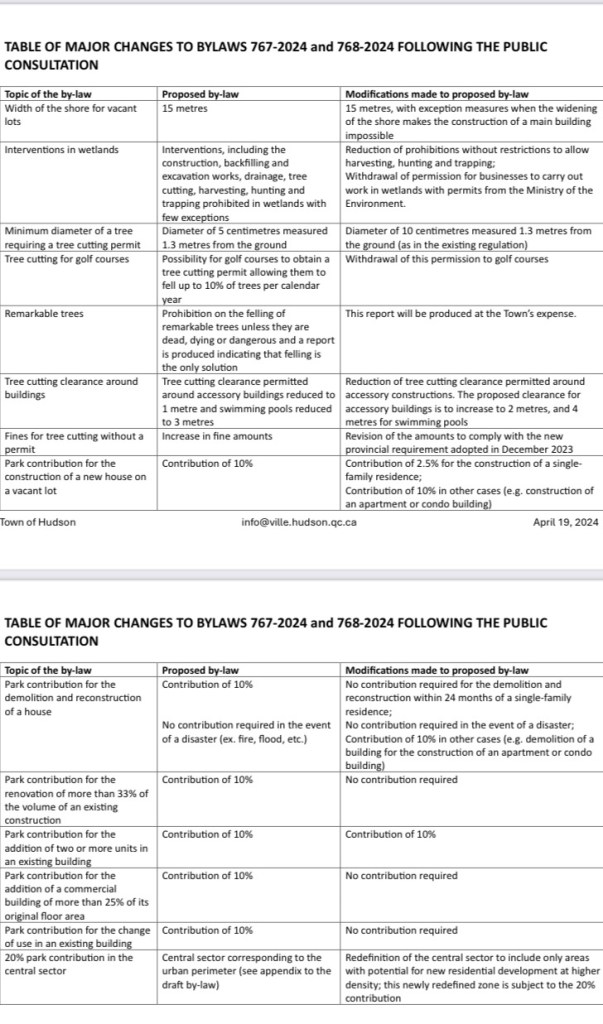

The list — posted Friday on the town’s website — compares only those sections changed as the result of concerns raised in the public consultation process. It does not permit comparison with urban planning bylaws currently in force.

Still unclear is how the revisions to draft bylaw 767 will “redefine Hudson’s central sector to include only areas for potential for new residential development at higher density.”

The original draft bylaw had proposed to apply a 20% land/cash “contribution” on new residential development anywhere within Hudson’s urban perimeter, which represents nearly half of Hudson’s total land area (Hudson’s Valleys, Alstonvale and a handful of neighbourhoods in the east and west ends are excluded from the town’s urban perimeter because they are still classified as agricultural.)

The most significant changes:

Wetlands:

— The 15-metre shoreline buffer will allow exceptions when the wider buffer makes it impossible to build;

— Withdrawal of the town’s permission to businesses with permits from the provincial environment ministry to carry out work in wetlands;

— Withdrawal of restrictions on hunting, trapping and harvesting in wetlands.

Trees:

—The minimum diameter of trees allowed to be cut without a permit has been restored to 10 centimetres;

— Tree-cutting fines have been revised to comply with provincial requirements adopted in December;

— Golf courses lose the right to cut up to 10% of their trees per year;

— The Town will now pay for assessment of whether one of Hudson’s 188 “remarkable trees” needs to be felled;

— Tree-cutting setbacks around pools and accessory buildings have been increased.

Parks and greenspace tax:

— The 10% parks tax has been removed for additions or renovations unless the purpose is to add two or more units to an existing building or to demolish an existing building to make way for an apartment or condo complex (still 10%);

— The contribution for construction of a new single-family residence is being cut from 10% to 2.5%;

— No contribution is required for the demolition and reconstruction within 24 months of of a single-family residence.

As announced, residents will be advised of the revisions at a public meeting (7 p.m. Wednesday, April 24 at the Community Centre). Like the draft bylaws, they are not subject to approval by referendum. Unlike the bylaws, they are not subject to further consultation prior to their adoption at the May council meeting.

The main concern should be how these revisions are worded in the revised bylaw. The conforming usages in Hudson’s residential and commercial sectors are clearly identified in bylaws 525 and 526, Hudson’s current zoning bylaws. How is this proposed central sector identified? One might infer that it would include the stretches of Main and Cameron where intensive development has long been rumoured, but it could also be applied to the quadrilateral between Mount Pleasant, Côte St. Charles, Lakeview and the railway right of way.

We have received mixed signals from the current council over its intentions for the core. Mayor Chloe Hutchison has hinted in the past at the possibility of a plan particulier d’urbanisme, a provincial urban planning instrument that allows a municipality to consult with property owners to come up with a comprehensive redevelopment plan without citizen input. Council recently approved a money resolution to hire a facilitator in discussions with developers.

Last week, District 6 councillor Daren Legault posted: How is this any different from the idea that some people have: that any new development, any new construction in town should pay a levy up front to cover their “buy in” to the town’s existing infrastructure. I believe that the levy I mention was something you pushed for? Please correct me if if I’m wrong. The results that you now say you were worried about with the bylaw proposals would be no different in my opinion.

It’s a fair question, especially in light of my written comments to council in response to the public consultation:

I was extremely disappointed to note the absence of a section imposing connection fees on the developer. Most municipalities in North America charge developers the entire cost of connecting to existing infrastructure, plus any unforeseen connection costs incurred by the town. (Example: a still-valid development agreement signed by the town and the developer of Sandy Beach saddled Hudson taxpayers with roughly $350,000 in expenses.) Quebec has given municipalities the power to require that these costs of hooking up to water, sewers, drainage, roads, trails and other public infrastructure, so why is it not part of these proposed bylaws?

I ask that council consider taking it a step further by assessing any existing or future residential or commercial expansion the cost of replacing the capacity of our drinking water, sewage treatment and other municipal systems consumed by their project. Surely this is a far easier way to fundraise for a parks and greenspace fund than taxing renovations?

In that context, a levy on large-scale densification projects is logical. But what may be fair and equitable for a 20-unit apartment or condo project is neither fair nor equitable for a small infill project somewhere in the quadrilateral that characterizes the downtown core. Until residents get a clear view of what is being proposed, it’s a legitimate question that remains to be answered.